It all starts with an idea. Become a client of SPARK’s startup incubator and business accelerator to access grants, work with mentors, and more.

Are you looking for help launching a new product or service? Ann Arbor SPARK can guide you through refining your idea and launching a business. The entrepreneurial services team has multiple programs and resources to help you get started, as well as affordable office space. Complete this form to get started.

For entrepreneurs, the goal of the idea stage is to achieve problem-solution fit and develop a minimum viable product (MVP) that can be tested, improved, and launched in your target market.

The biggest risk at this stage is over-focus on the product and too little focus on your future customers, which leads to building something no one wants to buy.

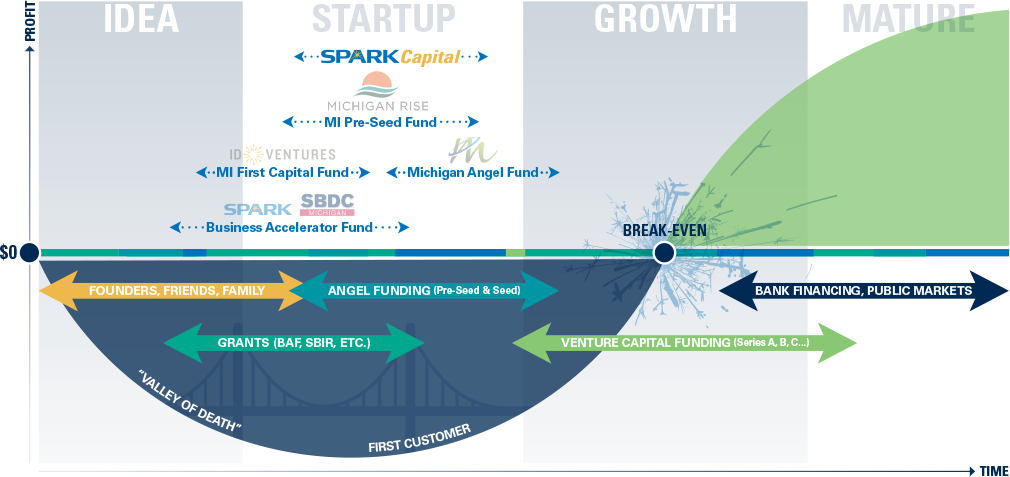

Company Lifecycle and Funding Sources

Please Note: The company lifecycle graphic is a simplification of capital markets and may not apply perfectly to each company or industry. For example, most angel and venture investors only invest in technology companies, not traditional businesses like restaurants, retail, or real estate.

Idea Stage Companies

Technology companies in the idea stage may be thinking of raising angel and venture capital to grow. To do that, you’ll need to create a business that scales and generates huge returns to investors (usually 10x or more). Most ideas come from a founder’s background, education, and interests — which may or may not translate into a scalable business. To scale, the idea will have to be new, differentiated, and address a big problem in a large potential market (usually >$1B), while generating high gross margins. More on angel investors and venture capital (VC) below.

Non-tech small businesses are less likely to scale and get venture capital funding. Small businesses should focus on getting to cash-flow positive to qualify for traditional forms of funding like bank financing. Usually, the success of small businesses — restaurants, retailers, service providers, etc. — depends on the local economy. You’ll need to assess local demand and competition to determine if there’s a market gap or competitive advantage in launching your business.

In any case, if you’re going to need funding from outside investors (angel investors, venture capital funding, bank financing, etc.), your idea must become a viable business. This stage is all about developing and testing your idea with all the entrepreneurial tools at your disposal.

First and foremost, a successful business is a function of its market — what customers need and are willing to pay to solve the problem. As a result, there are multiple customer-focused steps you need to take to maximize your chance of success and avoid wasting your time. This includes developing your value proposition hypothesis, doing market research, product development, planning the business, and funding the business.

Value Proposition

The value proposition is the value you communicate and deliver to customers. It’s why customers buy from you and is therefore critical that it’s based on their values and needs. In crafting your value proposition, it is helpful to use the Value Proposition Canvas, which matches your product’s value proposition with the customer profile (jobs, pains, and gains). Your value proposition is the business hypothesis that you will test and prove during the idea stage.

Market Research & Customer Discovery

To test and refine your value proposition, you have to learn about your potential customers. This includes understanding your customer personas, the potential size of the market, and competitors.

A key part of this is customer discovery, where founders interview as many potential customers as possible. It’s vital to understand customer needs and problems and get feedback on your value proposition. Without these steps, you’re likely to build something no one wants.

Product Development

If you’ve taken the time to thoroughly complete the previous steps, you’ll be close to achieving problem-solution fit and ready to develop a product that addresses your customers’ problems and needs. For tech companies, in particular, this is complex and therefore easy to lose sight of customer needs in the middle of the technical work. Product development should always keep the customer in mind. This can involve many cycles of ideating, developing, testing, and validating against the customer needs, to first achieve a proof of concept, then develop a prototype, and eventually get to a minimum viable product (MVP).

You’ll find it helpful to follow the process of User-Centered Design, a framework that can help you focus on empathizing with the needs of the customer to create a problem-solution fit.

It’s also smart to learn the Lean Startup Methodology, particularly for technology companies, which will help you refine your value proposition hypothesis by applying “build-measure-learn” cycles to get to problem-solution fit. This model continues to be useful in reaching product-market fit in the subsequent startup stage.

Planning and Forming the Business

The days of writing a 100-page startup business plan may be over, but you must clearly and realistically think through all aspects of the business — value proposition, market analysis, business model, go-to-market plan, financial projections, etc. Write it all down but remain open-minded and adaptable.

At a minimum, the Business Model Canvas is a very helpful tool to sketch out the business on one page. It ties your value prop to the external and internal factors of the business in order to visualize and plan each aspect in more detail.

Tech companies needing investment capital might also start building a pitch deck at this point, which distills and communicates the most important aspects of the business for investors. There are many great pitch deck resources out there and the process can help distill your own thinking about the business and put you in the shoes of potential investors.

Founders should also begin creating three-to-five-year financial projections during the late idea stage. Developing your projected income statement, balance sheet, and cash flow forces you to think about the drivers of revenue, costs, funding needs, cash flows, and valuation of the business. This is critical to managing the business and is required by investors and lenders. There are many resources to help create your projections, including the Michigan Small Business Development Center, which offers free consulting.

Of course, you’ll need to name the business, register it, get a tax ID, and complete any other licensing and regulatory requirements depending on your industry and geography. Again, there are many resources, including Ann Arbor SPARK, MI-SBDC, and others, to help guide you.

Funding Your Business at the Idea Stage

Idea stage businesses are speculative investment prospects with many challenges yet to overcome. Even after creating an MVP, there will be many more “build-measure-learn” iterations on the path to product-market fit. And there are more challenges after that, all of which investors view as risks — adoption risk, business model risk, execution risk, funding risk, market risk, etc.

Even venture capitalists and angel investors have a limit on their risk tolerance, and most won’t invest at the idea stage. Angel investors are more likely to invest in pre-seed and seed funding rounds during the startup stage, after initial customer traction. Most venture capital funds invest in the growth stage, after product-market fit when the business is ready to scale. But setting the right foundation by following idea stage best practices will position you well.

In short, idea stage entrepreneurs have to bootstrap through various means:

- Personal investment (savings)

- Personal debt (credit cards, personal loans, etc.)

- Raise money from friends and family

- Equity for work (grant shares of the company, in lieu of pay, to get help with product development, market research, etc.)

- Stay lean and keep costs as low as possible.

- Get customers (self-funding through revenue).

Raising money from well-off friends and family is common at this stage. And it’s possible to raise several hundred thousand or more depending on your network and effort. Founders often wait until after they’ve developed something tangible (a prototype) to approach friends and family. Conduct online research and talk to other entrepreneurs that have done it before for tips. In general, treat friends and family investors like your future angel and VC investors — give them your pitch, provide information, be transparent about risks, ask for their investment, and have a convertible note ready to sign (which will convert into shares of equity in a subsequent round).

Technology companies may have access to grant funding sources in Michigan, usually after some progress on product development. Here are some potential grant sources:

- Business Accelerator Fund: Up to $50,000 that can be used for startup services including legal, accounting, marketing, and business development.

- SBIR / STTR Grants: Phased federal grants used to fund research and development (R&D) with the potential for product commercialization, with available funding potentially exceeding $1 million for companies that reach Phase III.

- Michigan Emerging Technologies Fund: State grants that match SBIR/STTR federal grants, up to $25,000 for Phase I and $125,000 for Phase II. Tech startups in Michigan nearing an MVP might also qualify for pre-seed funding from the First Capital Fund, managed by Invest Detroit Ventures (ID Ventures) on behalf of the state. The fund invests statewide and often begins talking to companies during the late idea stage.

The good news is that if you can successfully bootstrap through the idea stage, there are many more sources of capital that will become available, beginning in the startup stage.

In addition to helping you best position your startup for investment, Ann Arbor SPARK can help you graduate your business from the idea stage. Learn more about our programs, including the SPARK Entrepreneur Boot Camp, upcoming workshops and events, and finding office space.

Share Your Business Idea

Contact the Capital Programs Team

Connect with the experts to learn more about raising capital or if you’re interested in supporting startups by becoming an angel investor.