“It’s simple, it’s just not easy.” -unknown

The pitch deck (a slide presentation designed to attract investors) is a necessary tool for tech startups trying to raise money. In addition, developing a good pitch deck can be a powerful exercise in helping you improve your thinking about your business and refine your plan. I stress this second point because many entrepreneurs view the pitch deck as an annoying, but necessary evil. Most entrepreneurs are running 100 mph and have many varied and complex issues to address. But if you slack on your pitch deck, it will show. And it’s often your first appeal to investors (hopefully not your last). The real bonus is that it forces you to slow down briefly and see the forest for the trees, and take a more objective view of your business. In that sense, it’s probably helpful even for entrepreneurs not planning to raise outside money.

With that in mind, here are some tips on how to create a good pitch deck.

The Basic Outline

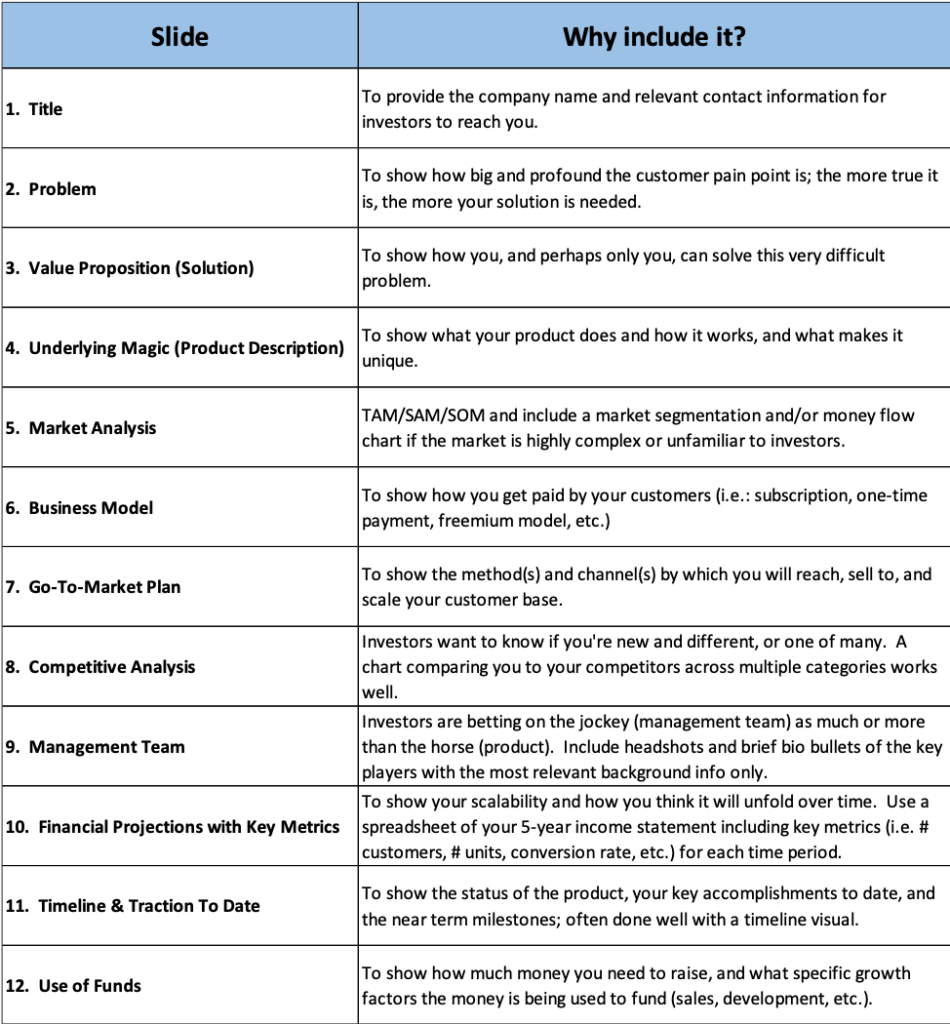

I always recommend using Guy Kawasaki’s “The Only Ten Slides You Need in a Pitch” as a baseline model. It basically covers everything you’ll need in your pitch. Here’s a slightly revised version, with my preference for 12 slides:

You may need to add to this slightly, particularly if you need another slide or two with important visuals that support the main slides. But in general, these 10-12 (or 15 max) slides cover what you need.

- Title: To provide the company name and relevant contact information for investors to reach you.

- Problem: To show how big and profound the customer pain point is; the truer it is, the more your solution is needed.

- Value Proposition (Solution): To show how you, and perhaps only you, can solve this very difficult problem.

- Underlying Magic (Product Description): To show what your product does and how it works, and what makes it unique.

- Market Analysis: TAM/SAM/SOM and include market segmentation and/or money flow chart if the market is highly complex or unfamiliar to investors.

- Business Model: To show how you get paid by your customers (i.e.: subscription, one-time payment, freemium model, etc.)

- Go-To-Market Plan: To show the method(s) and channel(s) by which you will reach, sell to, and scale your customer base.

- Competitive Analysis: Investors want to know if you’re new and different, or one of many. A chart comparing you to your competitors across multiple categories works well.

- Management Team: Investors are betting on the jockey (management team) as much or more than the horse (product). Include headshots and brief bio bullets of the key players with the most relevant background info only.

- Financial Projections with Key Metrics: To show your scalability and how you think it will unfold over time. Use a spreadsheet of your 5-year income statement including key metrics (i.e. # customers, # units, conversion rate, etc.) for each time period.

- Timeline & Traction to Date: To show the status of the product, your key accomplishments to date, and the near-term milestones; often done well with a timeline visual.

- Use of Funds: To show how much money you need to raise, and what specific growth factors the money is being used to fund (sales, development, etc.).

Commentary

There are many good resources on each of these slide topics, and so I won’t comment on all of them, but here are a few points to consider now:

The Problem: Possibly the most important slide. Investors want to invest in companies addressing big problems, ideally where customers are desperate for a solution (‘need to have’ vs. ‘nice to have’). If you need to work really hard to convince investors, and/or yourself, about a problem that might not be this significant, you may need to stop everything now and reassess before you go any further. This is a common issue that arises when a solution gets created before truly assessing the problem via customer discovery (the classic ‘product searching for a market’).

Underlying Magic (Product Description): Investors need to quickly understand your product and its differentiation in the market. Clear and informative visuals of the product itself and/or flow-chart(s) often work well. If you don’t do a good job of quickly articulating what your product does and how it works at a basic level, you’ll likely lose credibility with investors, partly because they’ll view it as a negative reflection on your ability to make initial sales.

Market Analysis: If you’re in a complicated, multi-sided, multi-player market or if some of your potential investors lack market knowledge, I would recommend including a market segmentation and/or money flow-chart and indicate the area(s) of the market that you’re addressing specifically. You can then include your TAM/SAM/SOM figures within this larger visual context. This can show the depth of your micro and macro expertise, and can speed up the conversation with less knowledgeable investors. Caution: Make sure your TAM/SAM/SOM is reasonable and well thought out from both top-down and bottom-up perspectives.

Competitive Analysis: Show all of your significant direct competitors, including the status quo if appropriate. Be sure to make comparisons on all of the most important criteria, and leave out the trivial. If you fail to include relevant competitors and/or meaningful criteria, potential investors may recognize that immediately, or find out in due diligence, and you’ll be seen as lacking either basic market knowledge or transparency.

Financial Projections and Key Metrics: Here investors want to understand the scaling and unit economics of the business over time, and that your thinking is reasonable. You’ll want to illustrate that in enough detail to provide an adequate picture on one slide, without including your entire financial model. Most angel and VC investors will be looking for 100-200 percent year over year growth and a 5-year revenue projection that would command a large exit value based on revenue multiple (i.e. 10x of initial investment). Don’t exaggerate your projections to fit the VC/angel investment model – it will be apparent to investors. You’re better off being honest with yourself up front on whether your business fits this model (see A Few Fundraising Basics for New Startups for more on this).

Good Rules of Thumb

As a general rule, don’t bog down your audience with text or clutter. Instead, clearly and concisely tell the story of the business with just the right amount substance to be understandable and compelling. Some good reference points here are Kawasaki’s 10-20-30 Rule and the 3 C’s of effective communication:

- Be Clear: Use short, simple language, and nail the main ideas;

- Be Compelling: Tell a story and focus on customer benefits;

- Be Credible: Provide defensible evidence and don’t exaggerate.

This again suggests, as much as possible, the use of illuminating visuals versus text. A good picture (or graph, chart, “Smart Art”, etc.) really is worth a thousand words in a pitch deck.

Getting it down to this level of simplicity and clarity is not an easy task, so, put some time and effort into your pitch deck, and enlist help and seek feedback. I think you’ll find great benefit by: 1. increasing your odds of attracting investment, and 2. gaining deeper insight around your business as you step back and boil it down to its essentials, which will ultimately impact your fundraising and operational success.

Resources

In addition to Guy Kawasaki’s work, there is no shortage of helpful information online, including many sample decks that might provide inspiration. At the Michigan Angel Fund, we work closely with the New Enterprise Forum (NEF), which is a great volunteer organization that can help you craft and refine your pitch. There are many other groups within Michigan’s entrepreneurial ecosystem that can help, including university affiliated programs, Michigan’s SmartZone’s, like Ann Arbor SPARK, and the Michigan SBDC.

Good luck!