It all starts with an idea. Become a SPARK client to access grants, work with mentors, and more.

Are you looking for help launching a new product or service? Ann Arbor SPARK can help tech companies navigate the startup stage. The entrepreneurial services team has multiple programs and resources to help you get started, as well as affordable office space. Complete this form to get started.

The startup stage begins after you’ve created a minimum viable product (MVP) that is ready to be tested in your target market.

This was the goal of the idea stage. The main goal of the startup stage is to launch your product and achieve product-market fit.

Product-market fit (PMF) describes how well your product meets market demand and is evidenced by strong customer growth and retention. Finding product-market fit is often a dynamic and experimental process that starts in the idea stage with good customer discovery and iterative product development.

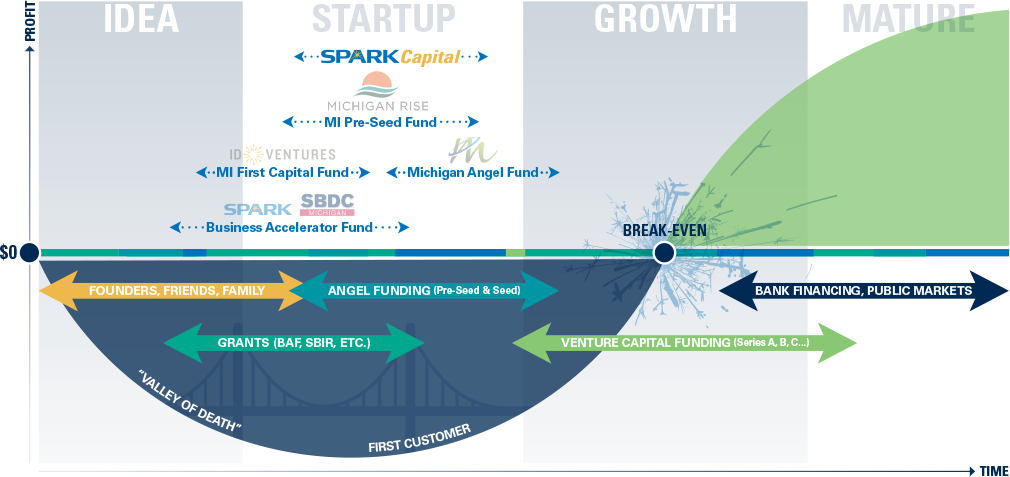

Company Lifecycle and Funding Sources

Please Note: The company lifecycle graphic is a simplification of capital markets and may not apply perfectly to each company or industry. For example, most angel and venture investors only invest in technology companies, not traditional businesses like restaurants, retail, or real estate.

Product-Market Fit

In the startup stage, the search for PMF continues through beta testing your MVP in real-world settings. The goal is to collect feedback on usability and improve the product for release. After the initial product release, you’ll probably need to continue to iterate and refine the product, market, or both to get to product-market fit.

Some get to product-market fit right out of the gate, meaning you had an accurate value proposition hypothesis that fit a large market need and created a correspondingly great product. You’ll know because it will be hard to keep up with customer demand after release. In this case, you may not need much startup funding from investors. But for many companies, particularly tech companies, achieving PMF won’t be that easy and could take a couple of years to reach.

Tech Startups

For tech startups, pre-seed funding may be available from investors in the late idea stage or early startup stage and is often used to complete product development and launch the MVP. Pre-seed funding usually comes from founders, friends, family, and maybe some adventurous angel investors. It is usually best to take in pre-seed funding through a convertible note structure because it’s too early to put a value on the company through an equity round. The size of pre-seed rounds varies by company and industry but may range from $100,000-$500,000, aggregated from many individual investors.

Pre-seed Investment Funding

In Michigan, tech startups might be eligible for pre-seed investment funding from:

- Michigan First Capital Fund: Statewide investment fund, managed by ID Ventures on behalf of the state, which invests $50,000 – $150,000.

- Michigan Rise Pre-Seed Fund: Statewide co-investment fund, managed by Red Cedar Ventures on behalf of the state, which invests $100,000 –$250,000.

- SPARK Capital: Co-investment fund managed by Ann Arbor SPARK which invests up to $250,000.

- Angel Investors: High-net-worth individuals that invest in startups, often in groups, like the Michigan Angel Fund. Michigan has over a dozen angel groups and thousands of current or potential angels.

- Early-Stage VCs: some venture capital funds do invest at the pre-seed and seed stages.

Grant Funding

Michigan tech companies can also apply for grant funding sources at this stage depending on the industry:

- Business Accelerator Fund: Up to $50,000 that can be used for startup services including legal, accounting, marketing, and business development.

- SBIR / STTR Grants: Phased federal grants used to fund research and development (R&D) with the potential for product commercialization, with available funding potentially exceeding $1 million for companies that reach Phase III.

- Michigan Emerging Technologies Fund: State grants that match SBIR/STTR federal grants, up to $25,000 for Phase I and $125,000 for Phase II.

Seed funding for tech startups in today’s market is usually not available from investors until there are some paying customers and possibly some evidence of customer retention. Seed investors — which can include angels and early-stage venture capital funds — want to see that the company has traction with early adopters, a solid go-to-market plan, and the potential to gain broader market adoption, among other things. Seed rounds typically range from $750,000 – $2 million and are often done as equity, through preferred stock, where a valuation of the company is set. Funds will be used primarily to fuel sales and marketing but also for continued product development and operations.

Accelerators are another resource that startups should explore in the startup stage. Accelerators are usually run as cohort models, where selected companies go through a rigorous boot camp to apply startup best practices and accelerate their progress. Many accelerators provide small amounts of startup funding to their clients and are well connected with investor networks. In addition to Ann Arbor SPARK’s Incubator Program, there are many good accelerators throughout the country, like Y-Combinator, TechStars, AngelPad, and 500 Startups. In the region, SPARK works closely with the University of Michigan’s Desai Accelerator.

In addition to accelerator programs, companies can find affordable office space and supportive entrepreneurial communities through Michigan’s SmartZone Network. This includes Ann Arbor SPARK and other regional SmartZones throughout the state, some of which like SPARK offer incubator office space, entrepreneurial services, and collaborative community events within an entrepreneurial ecosystem. Locating within a SmartZone like SPARK is a great way to get a leg up in your entrepreneurial journey.

All of these resources can help a company get through the ‘valley of death’ of startup stages. After receiving funding, business owners need to be aware of their burn-rate — how quickly they’re losing money — and their runway — the number of months until funding is depleted. Startup businesses need to stay as lean as possible as they search for product-market fit. Strong headwinds, like long sales cycles and low conversion rates (basically if your product isn’t selling like hotcakes) probably mean you haven’t reached PMF. In which case you’ll need to refine the product and, market, or both. More often than not, you may even need to make a more drastic pivot. Startup businesses need to walk the fine line of open-minded experimentation and fast execution under diminishing time and funding.

Non-Tech Small Businesses

Non-tech small businesses typically have less time to reach product-market fit because there are fewer small business investors, as compared to tech startup investors.

Most VCs and angel investors seek large returns in relatively short timeframes, often 10 times their investment in five to seven years. The majority of small businesses aren’t scalable enough to achieve that.

Most non-tech small businesses will therefore need to bootstrap (savings, credit card, and personal loans) through the startup stage, possibly refining their offering along the way, to get to revenue as soon as possible. However, some lending sources may become available depending on the company’s cash flow and collateral position, including:

- Microloans: Small business loans, often under $50,000, sometimes government-backed, as with SBA and CDFI microloans, and some through non-profit lenders like Kiva.

- Michigan Capital Access Programs: Profitable companies might be eligible for support from Michigan Economic Development Corporation’s (MEDC) loan enhancement programs, making it possible to get traditional bank financing that’s otherwise unavailable.

- SBA Loans: Profitable small businesses might pursue a loan backed by the U.S. Small Business Administration, which works with banking institutions to provide financing that would otherwise be unavailable.

Small businesses are more reliant on their local economy. Their decision to launch should be based on whether there is a market opening and competitive advantage to existing local businesses. If so, effective marketing and execution should attract local demand, and revenue, which can open up outside funding, like business loans.

Challenges

Given the challenges of this stage, both tech and non-tech companies need to prepare. You can learn more about preparation during the idea stage. In general, educate yourself to have an operating framework and business plan, while staying open-minded and adaptable. There are many good resources — books, blogs, videos, seminars, etc. — by successful entrepreneurs (e.g., Eric Ries, Steve Blank, Guy Kawasaki) to help you navigate.

Keys to the Startup Stage

- Use lean startup and customer discovery methods to get to PMF.

- Keep costs as low as possible and delay new hires until you have too much to handle within the founding team (who wear many hats).

- Narrow your focus on a beachhead market — a small market with specific characteristics that make it an ideal target to sell a new product or service. Once you’ve achieved PMF, then expand.

- Your marketing team needs to be proactively involved in translating customer needs to the product development team to get to PMF.

- Develop and track key performance indicators (KPIs), to gain the qualitative and quantitative insights needed to improve daily.

- Do whatever is required to get to PMF, including changing out people, rewriting the product, moving into a different market, and telling customers no when necessary. Sales and marketing in the traditional sense are essentially a waste of time without PMF.

Investors see many business plans, hear many pitches, and do their due diligence. They can spot the companies doing the right things.

With some good fortune and great execution, you’ll get through the startup stage with a great product, a sales and marketing engine that is starting to hum, significant customer traction, and product-market fit. At this point, some companies will opt to reach break-even and fund themselves with profit going forward. Other companies, particularly those with a path to exponential growth, will choose to raise additional capital, primarily from venture capitalists in the growth stage, with more tranches of funding — Series A, Series B, Series C funding, etc.

Share Your Business Idea

Contact the Capital Programs Team

Connect with the experts to learn more about raising capital or if you’re interested in supporting startups by becoming an angel investor.