Valuation is one of the main concerns you’ll encounter when raising equity investment for your technology startup. And it’s important as an entrepreneur to understand how investors think about valuation, ideally before you start fundraising.

First, most experienced investors will be familiar with the valuation range for companies in their target market(s), stage(s), and geography(s). Valuation is at the core of their business and is key to their success. They likely review hundreds of opportunities per year on which to base their judgment. (For general reference, median angel investment pre-money valuation across all sectors was about $3.5 million in the first half of 2017.[1])

That’s not to say valuation is predetermined, but that there’s a clear starting range from the investor’s view. If your valuation target is way outside the ballpark, it probably won’t fit that investor’s strategy, and you’ll lose their interest. In that regard, it’s better to let investors arrive at their own valuation conclusion/range before you start negotiating for your own value target, or worse, set your own predetermined price on the round.

When doing a valuation analysis, there are many factors that investors will incorporate, including the team, technology, market, competition, revenue, growth rate, gross margin, revenue multiple, and churn, among others (see Tips on How to Improve Your Pitch Deck for more on some of these factors). In general, the longer your track record, the more the company’s financial metrics come into play. In contrast, the earlier stage the company, by definition, there will be less financial history for investors to analyze. In this case, valuation is more challenging and becomes as much an art as a science.

In either case, investors might start their analysis by finding “comps” in your sector/sub-sector — recent exits and exit multiples (usually exit multiples of revenue) of companies that are comparable to yours — to help ground their analysis in market reality. Recent private company exits and revenue multiples (= exit price / revenue) are preferred when available.

But investors often settle for public revenue multiples instead (= enterprise value / revenue), given the challenge of unearthing data on private company transactions. They’ll typically discount public multiples to some degree (20-30% on average) to account for the higher risk and lower liquidity of early-stage private companies.

For example, a comparable public company with enterprise value of $5 billion and revenue of $1 billion, results in a 5x revenue multiple, which might get discounted to say 3.7x. (Investors will seek out more data points to get to a better approximation, but let’s assume 3.7x for this example.)

This revenue multiple can then be used to derive an estimated exit amount, based on the company’s revenue projection at some future date[2]. For example, say the investor predicts an acquisition in year 5 at which point the company is projecting $30 million in revenue. Investors will likely discount this revenue projection, let’s say to $15 million for simplicity, and then apply that 3.7x revenue multiple, to arrive at a $55.5 million exit value[3].

Investors might then test potential pre-money values by modeling out the path to this exit with some intervening assumptions.

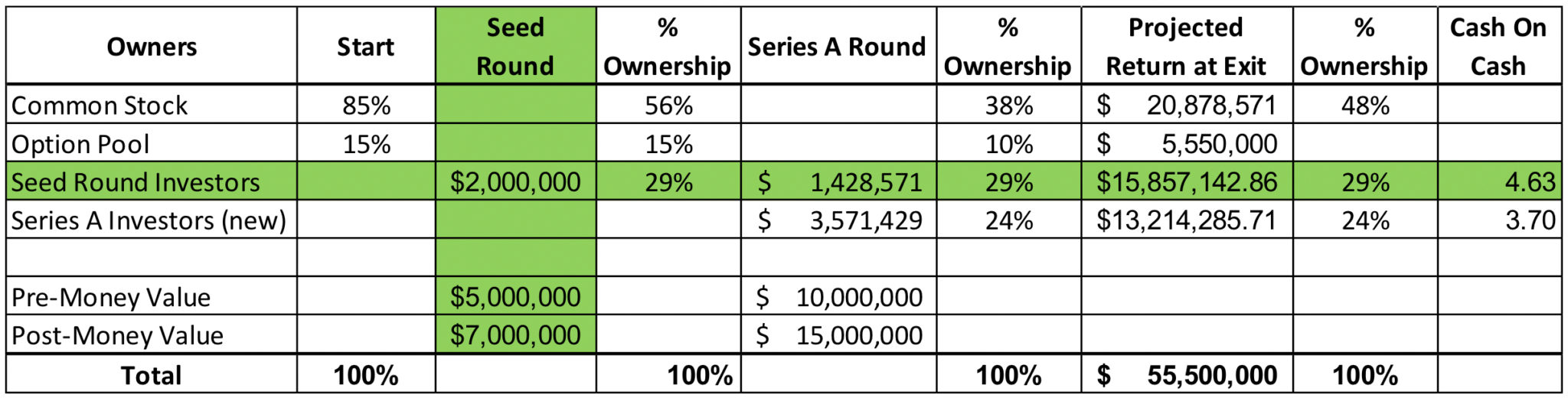

So, let’s say they want to make an initial $2 million investment and decide to test it at a $5 million pre-money valuation (“Seed Round” below), which would buy the investor(s) a 29% ownership-interest in the company ($2M investment / $7M post-money value ~ 29%). They then assume one additional growth round of $5 million (“Series A Round” below) prior to exit, in which they’ll invest their pro-rata share of the round (roughly $1.4 million), at a projected $10 million pre-money value. Then, when the company gets acquired for $55.5 million in year 5, the investor(s) get a return of roughly $16 million on their combined $3.4 million investment, for a cash on cash return (“COC”) of about 4.6 times their total investment ($15.86M / ($2M + $1.43M) ~ 4.6x).

This is a low return multiple for most early-stage investors, which are typically looking for 10x+ returns. However, they’ll also calculate the Internal Rate of Return (“IRR”) to assess the return relative to the amount time their money is invested (5 years, as projected here), which in this case comes to about 42%. That’s an outstanding IRR for early-stage investors and could offset the lower 4.6x COC multiple, depending on the investor’s strategy, potentially making it an attractive investment at $5 million pre-money.

If instead, both COC and IRR were too low for the investor(s), as projected, they could try running the model with a lower pre-money valuation, which would increase their ownership percentage and help get them closer to the expected return at that exit value. In other words, you’d get a lower than $5 million offer in that case.

Hopefully, this gives you a sense of the basic investor mindset and math behind startup valuation. In short, they usually begin with a projected exit in mind and attempt to backtrack from there and try to predict conceivable interim steps along the way, to arrive at a pre-money value (and hence ownership %) with a reasonable probability of leading to the expected return. Companies that don’t fall within those parameters will not be a fit for that investor group. (For more information on funding sources and their parameters, see A Few Fundraising Basics for New Startups.)

There are many other methods investors might use that complement this general thought process, including the Scorecard Method, Berkus Method, and even Discounted Cash Flow (usually not used until companies have actual cash flow). These methods are often utilized in combination to better triangulate a fair value of the company.

At the end of the day, startup valuation is clearly an imperfect process and, on some level, comes down to a negotiation between the investor and entrepreneur. Investors must use a lot of professional judgment in startup valuation work, which to a large extent is based on pattern recognition from prior investing experience. Nonetheless, these types of valuation techniques form the basis of and help structure the valuation conversation from an investor perspective.

**********

[1] Angel Resource Institute: 2017 Halo Report First-Half.

[2] Revenue multiples can also be directly multiplied by current revenue to derive pre-money valuation. But for true startups with little if any revenue, this often results in unnecessarily low valuations that don’t adequately value other important factors of the business.

[3] Incidentally, this would be too small of a projected exit for most venture capital funds, which seek exits in the $100s+ millions range. However, a $55.5 million exit might work for some smaller funds and angel groups, like the Michigan Angel Fund, which make smaller investments and seek out more capital efficient companies with shorter-term exit horizons.