Key Takeaways from Swisher’s 2022 Year-End Vacancy Report

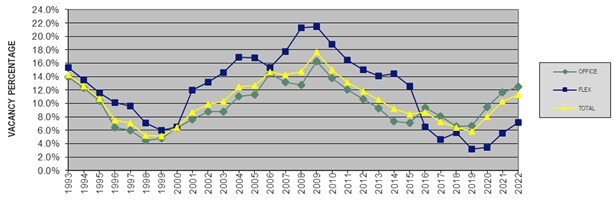

Last week, Swisher Commercial released the 2022 Year-End Vacancy Report. Swisher has produced an annual survey of vacancy rates for both office and flex space in the Ann Arbor area for 30 years now and it remains the most comprehensive public snapshot of commercial real estate vacancy in our area.

Melissa Sheldon, director of research for Ann Arbor SPARK, continuously analyzes commercial real estate trends in the region for two fundamental reasons: 1) understanding these trends helps us provide the best possible advice to companies looking for space (those already local and those new to the area), and 2) they are an important indicator related to the economic health of our region. Swisher’s report focuses specifically on the Ann Arbor market, which is very different from other areas in southeast Michigan, but can sometimes help predict market shifts in neighboring areas.

Here are Melissa’s top three takeaways, a few of the most compelling data visualizations from Swisher’s report, and a summary of what all of this information might mean as we move into 2023. The full report is available here.

- The pandemic continues to impact the demand for office and flex space throughout the Ann Arbor region as a mix of in-person, work-from-home, flexible, and hybrid work arrangements are ever-changing for most businesses.

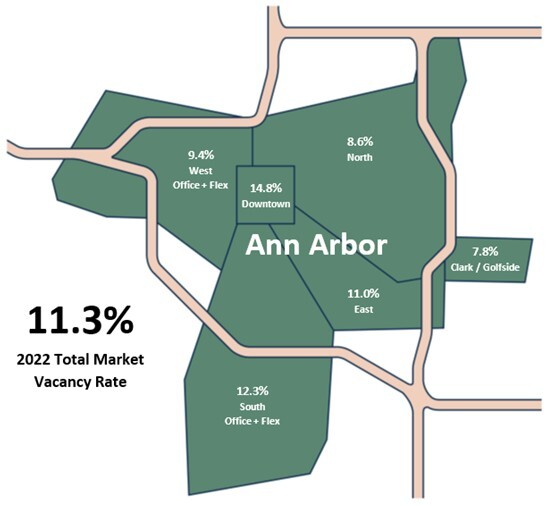

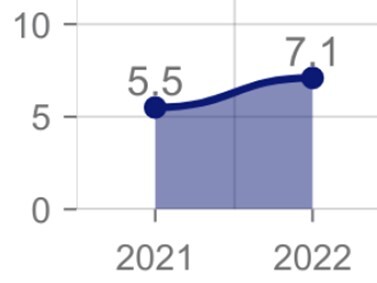

- Swisher surveyed 305 buildings of 5,000 square feet or larger, totaling nearly 11.6 million square feet. The total vacancy rate for office and flex space is 11.3 percent, up from 10.3 percent in 2021.

- The Ann Arbor region experienced very low vacancy rates prior to the pandemic, but businesses also had a hard time entering the market and finding space with such limited availability. Office and flex space vacancy rates in the ten percent arena are typically considered healthy and offer new entrants to the market an opportunity to find space.

- The Ann Arbor market has available space, and it has been exciting to see businesses, brokers, property owners, developers, and other stakeholders think creatively about their space needs and either repurposing or completely reimagining certain buildings or entire districts throughout the region.

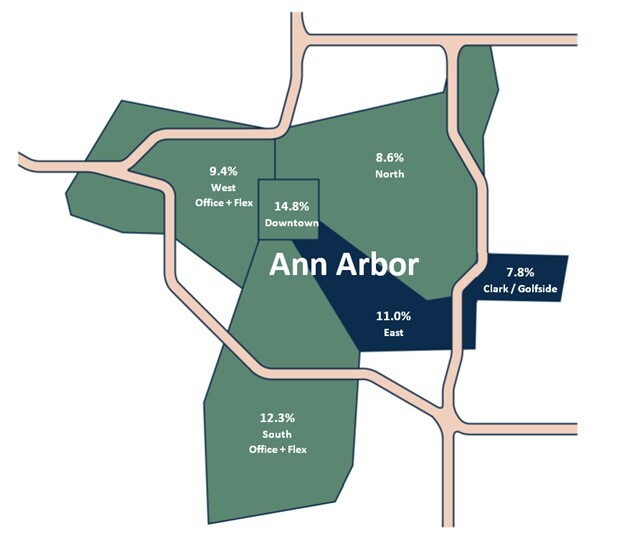

2. The only sub-markets in Ann Arbor with vacancy rates that decreased from 2021 to 2022 are the east office area and the Clark/Golfside medical office area, but the reasoning for the decrease differs between the two areas.

- Vacancy rates either increased or remained stagnant from 2021 to 2022 throughout all Ann Arbor areas except in the east and Clark/Golfside areas.

- The east Ann Arbor area vacancy rate decreased from 13.1 percent in 2021 to 11.0 percent in 2022. The east office area offers smaller suites with lower rent, which has been attractive to companies that have decided to downsize their physical space and leave the higher rent sub-markets.

- The Clark/Golfside vacancy rate decreased from 13.1 percent in 2021 to 7.8 percent in 2022 primarily due to larger medical institutions purchasing the properties. Once a property is owner-occupied, it is eliminated from Swisher’s annual survey.

3. Light industrial space remained the dominant sector in terms of building sales despite a slight decline in user demand for high-tech flex space.

- Flex/shop suites of a smaller size had the highest demand in 2022, contributing to the west flex area of Ann Arbor with the lowest vacancy rate in the market (2.8 percent, unchanged from 2021).

- Flex spaces with high-bay shop area and garage doors were rented very quickly while flex spaces with a higher percentage of office space did not move as fast.

- A new 35,000 sq. ft. light industrial speculative development is underway in the west flex area and is expected to be completed in the summer of 2023.

- Once again in 2022, the dominant sector among building sales was light industrial despite a slight increase in vacancy rates, possibly due to high inflation and recession fears beginning in the spring of 2022.

Looking ahead, what does this mean?

The commercial real estate market in the Ann Arbor region remains strong and adaptable despite higher vacancy rates than what we were accustomed to pre-pandemic, and flex space continues to be in high demand, which can only mean one thing – innovation remains a constant in the Ann Arbor region.

Speaking of innovation, many businesses are bringing new life to previously vacant existing spaces throughout the region by standing up co-working spaces in their owner-occupied buildings or implementing other creative and collaborative solutions related to their needs for physical space. Companies are increasingly more intentional when considering their needs for physical workspace, and some are downsizing by moving into new and nicer spaces. Is it possible we are experiencing an emerging trend of quality over quantity? Time will tell.

Repurposing space in the Ann Arbor market has been challenging as labor shortages and supply chain issues caused problems for businesses and property owners looking to enhance their space throughout the region, but some of those pain points started to ease up toward the end of 2022. MI-HQ’s acquisition of the former EMU Business School is a great example of a reimagined space that is being transformed to accommodate Michigan Medicine as the building’s anchor tenant. MI-HQ’s new facility will eventually put more flex/lab space on the market next year that will provide options for new entrants. It is possible that we will see space repurposed into various types of housing to help address the high cost and shortages in and around Ann Arbor. Plans are currently in the works to convert office space into 120 luxury apartments in the Ashley Mews building (formerly occupied by DTE), conversion of a city-owned parking lot into high-rise affordable housing, and at least 25 other exciting new developments to watch in 2023.

As the need for physical space evolves and 2023 unfolds, we will continue to monitor these trends to help businesses thrive in our region. Ann Arbor SPARK is committed to helping you launch, grow, and locate your business in the Ann Arbor Area. Reach out to Phil Santer, senior vice president, to be connected with the resources to help you find the perfect space for your business.

Useful Resources

Incubators, Accelerators, and Coworking spaces in the Ann Arbor Region

Explore Available Commercial Listings

Factors That Tech Firms Should Consider When Choosing a Location for Ann Arbor Office Space