Earlier this month, Swisher Commerical released its 2019 Year-End Vacancy Report. Swisher has been publishing this analysis for more than 25 years, and it remains the most comprehensive public snapshot of commercial real estate vacancy in Ann Arbor.

Alex West, director of research for Ann Arbor SPARK, tracks commercial real estate trends in the region. It’s important for two main reasons: these trends help us give the best advice to companies looking for space (both local and new to the area), and they are an important component to track for the economic health of our region. This report looks specifically at the Ann Arbor market, which is very different from other areas in

Here are some of Alex’s main takeaways and a few of the best visuals from the report. The full report is available here.

Main Takeaways:

Demand for office space in Ann Arbor continues to grow.

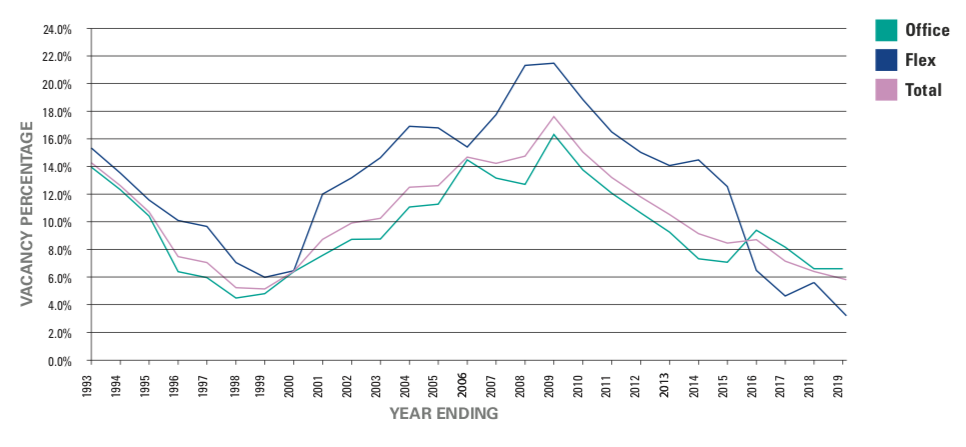

- The total market occupancy rate for office and flex space is 94.2%, up from 93.6% in 2018 and 79% during the Great Recession. This is now a 10-year trend of vacancy rate decreases.

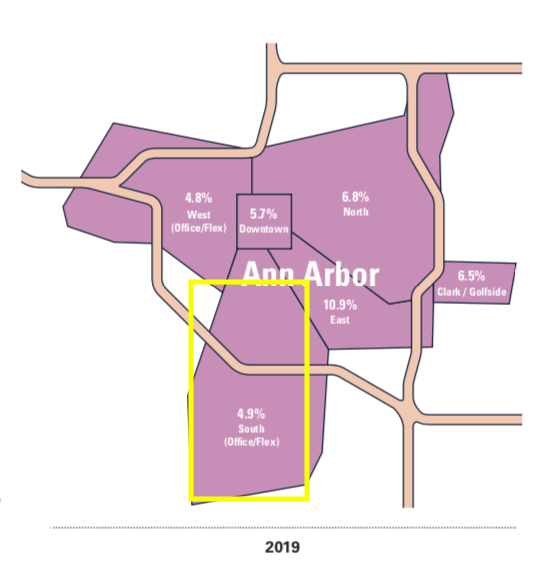

Demand is highest in south and west Ann Arbor.

- In a shift from the past two years of vacancy reports, the north area of Ann Arbor did not experience the lowest vacancy rate in 2019. This honor belongs to the south and west areas as a result of businesses relocating from the north area. However, based on historical demand for the north area and the limited space available, this vacancy rate is unlikely to last long. The south area continues to experience increasing demand, both in office and flex space.

- The north and south areas are difficult to compare since they differ so greatly in total square footage available. The north area is much more susceptible to small changes since its denominator of total space is much smaller.

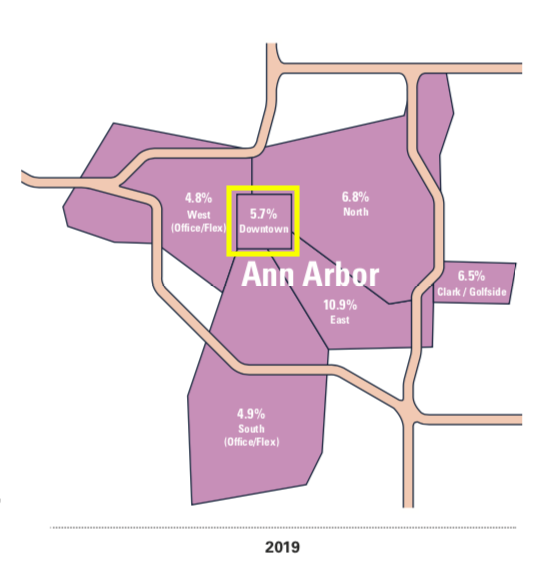

The vacancy rate in Downtown Ann Arbor is hovering around 5%, and that’s ok.

- The demand for downtown office space seemed to even out in 2019, hovering near 5% (up from the 1% levels seen a few years ago). Some larger companies are looking to less impacted markets like the south and west areas, leading to decreasing vacancy there as well.

- Downtown continues to be attractive to technology companies that view their location as a selling point to prospective talent and value the amenities available.

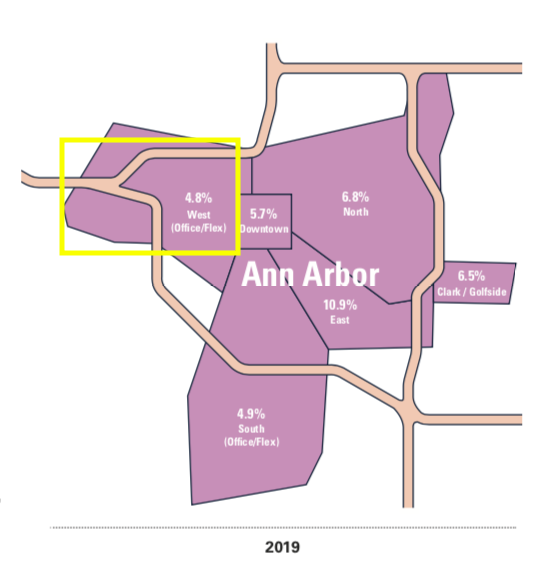

The west office area experienced nearly a 6% drop in vacancy rate. That’s a lot.

- There was a consistent demand for west area office space all year. One factor contributing to the drop in vacancy rate was the sale of a 35,000-square-foot building to an owner-user, which removes it from the report. In 2018, that building accounted for half of the total vacancies in the west area.

- Statistically, this is a small area subject to wide swings in the vacancy rate caused by changes, year-to-year, of the larger buildings.

All in all, the vacancy report tells the story of a vibrant real estate market and a thriving economy.