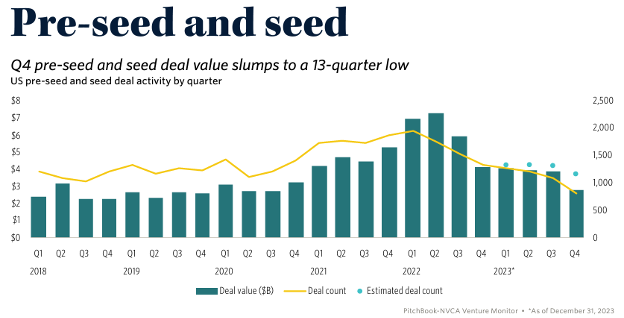

2023 was a challenging year for startups trying to raise capital and for investors trying to help their portfolio companies survive. Venture and angel investment levels were down significantly from the height of the prior several years due to market conditions, including inflation and interest rate levels. Many companies that had raised capital at the height of 2021-2022 found it challenging when they had to raise their next round in 2023. In turn, startups had to navigate this environment by extending their runways, often by cutting their cash burn, and raising bridge rounds as opposed to priced rounds in order to avoid down rounds. Some companies sought to exit but found a very challenging M&A and IPO market. And unfortunately, in some cases, companies were forced to wind down, which happened at double the rate from 2022.

All that said, SPARK Capital remained active throughout the year and made investments in 11 new high-growth-potential companies:

We also made follow-on investments in:

These investments supported a diverse set of dynamic founders from a wide range of industries including advanced manufacturing, life science, software, ag-tech, and climate tech — among others. They all have great growth potential and the ability to create high-wage jobs in Michigan.

Most of SPARK Capital’s portfolio companies were able to survive in 2023 despite the challenging funding environment, and many thrived, reaching critical milestones that will help lead to success in 2024. SPARK Capital has 58 companies in its portfolio.

Of note in 2023, SPARK Capital was among four nonprofit investment funds that were awarded new funding from the Michigan Strategic Fund. So, SPARK Capital is slated to receive $5 million in 2024 to increase our capacity for investment in Michigan startup companies. We are in the process of updating our SPARK Capital website with the funding criteria and application process. In the meantime, startups can still reach out through our current capital team contact form to submit information about their funding requests.

We’re cautiously optimistic about the market in 2024. We aren’t likely to see 2021–2022 investment levels again any time soon. However, interest rates and inflation are projected to decrease in 2024, causing some optimism that IPO and M&A activity will improve as well. And that should positively impact the capital markets overall, resulting in more funding for startups.

Happy New Year and wishing great success for Michigan entrepreneurs in the year to come!