Happy (belated) New Year! Along with all the end of 2018 wrap-ups and 2018 predictions is Swisher’s 2018 Year-End Vacancy Report. Swisher has been doing this analysis for over 25 years, and it remains the most comprehensive snapshot of commercial real estate vacancy in Ann Arbor.

As Director of Research for Ann Arbor SPARK, part of my role is to keep track of commercial real estate trends in the region. It’s important for two main reasons: these trends help us give the best advice to companies looking for space (both local and new to the area), and they are an important component to track for the economic health of our region. This report looks specifically at the Ann Arbor market, which is very different from other areas in

Here are some of my main takeaways and a few of the best visuals from the report. The full report is available here.

Main Takeaways:

Demand for office space in Ann Arbor continues to grow.

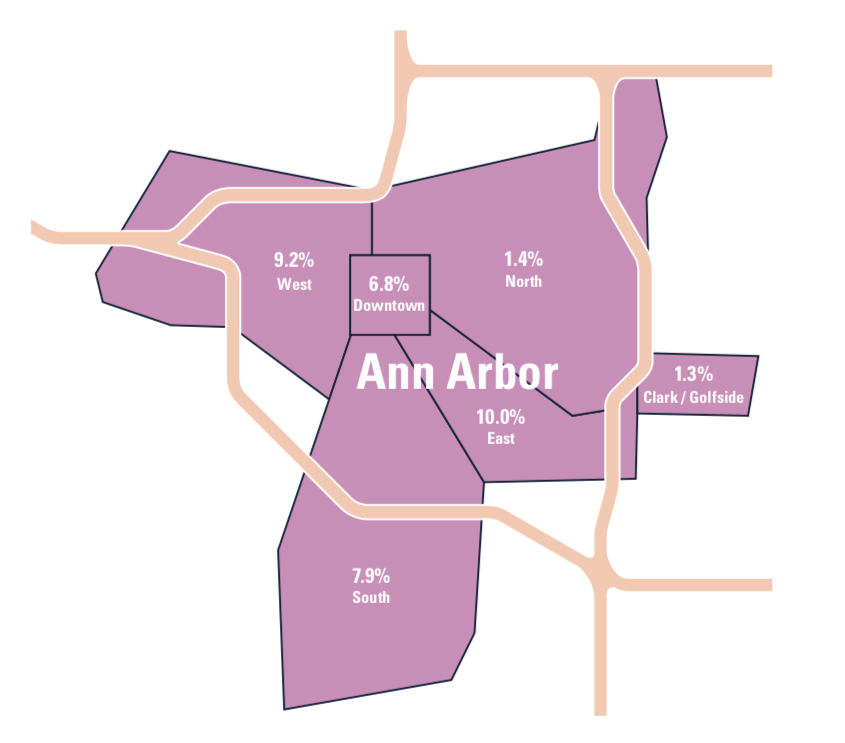

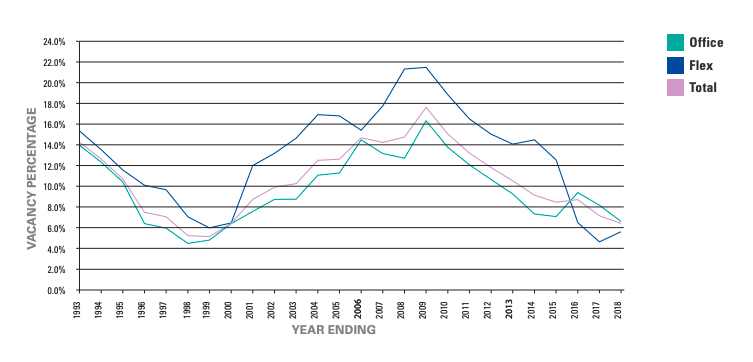

- The total market occupancy rate for office and flex space is 93.6%, up from 92.3% in 2017 and from 79% during the Great Recession – this is now a 9-year trend of vacancy rate decreases.

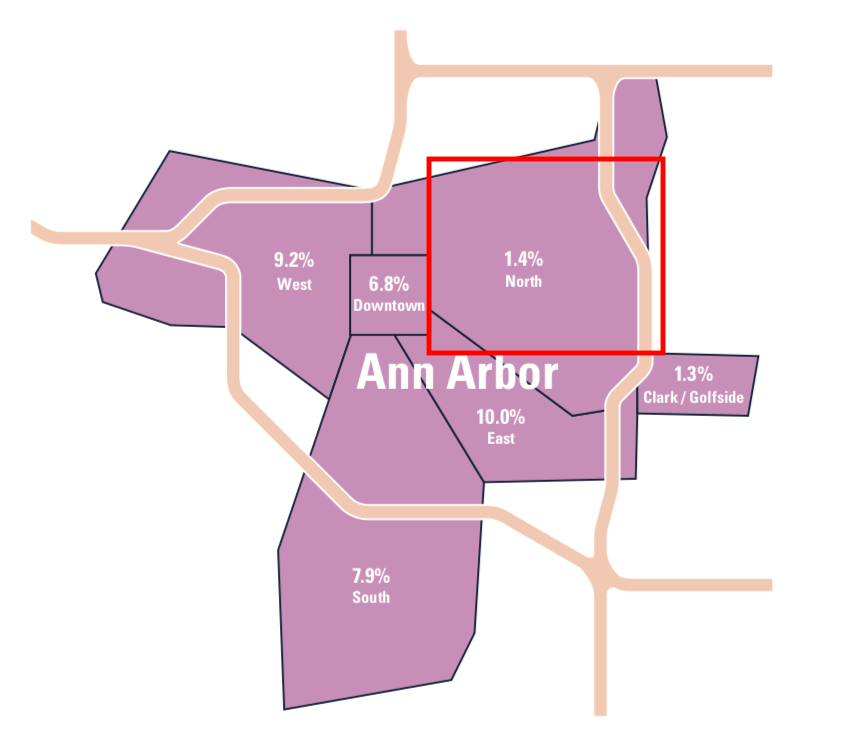

Demand is highest in North Ann Arbor, and in the medical campuses just east of M23.

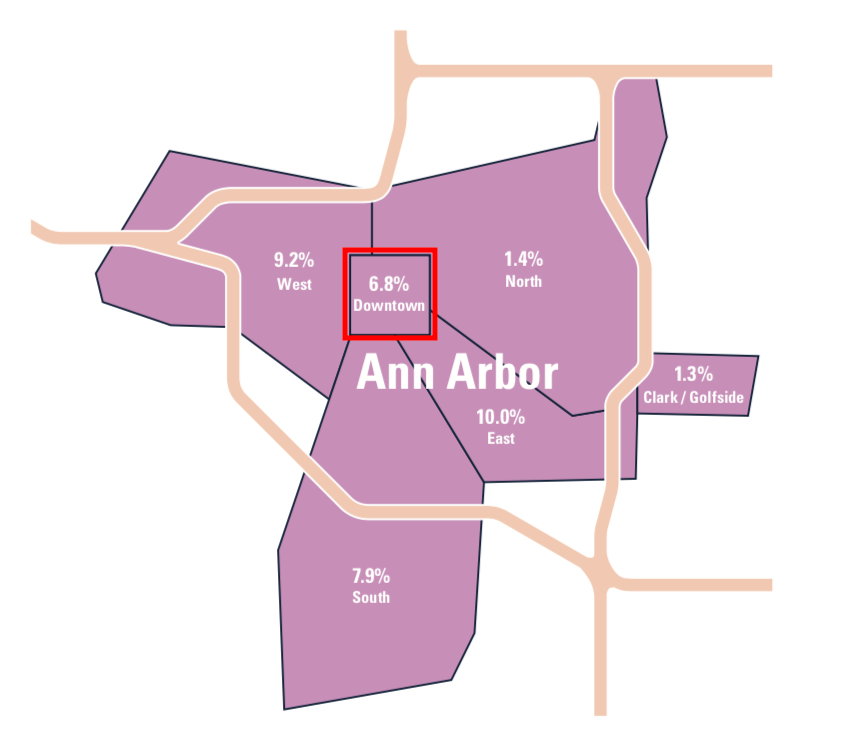

- It is difficult to measure the new demand for North Ann Arbor because there were very few vacancies to attract prospective tenants. A vacancy rate of 1.4% is remarkably low. Given its proximity to major University of Michigan medical and research facilities, plus easy highway access to surrounding suburbs, office space in this area is in high demand.

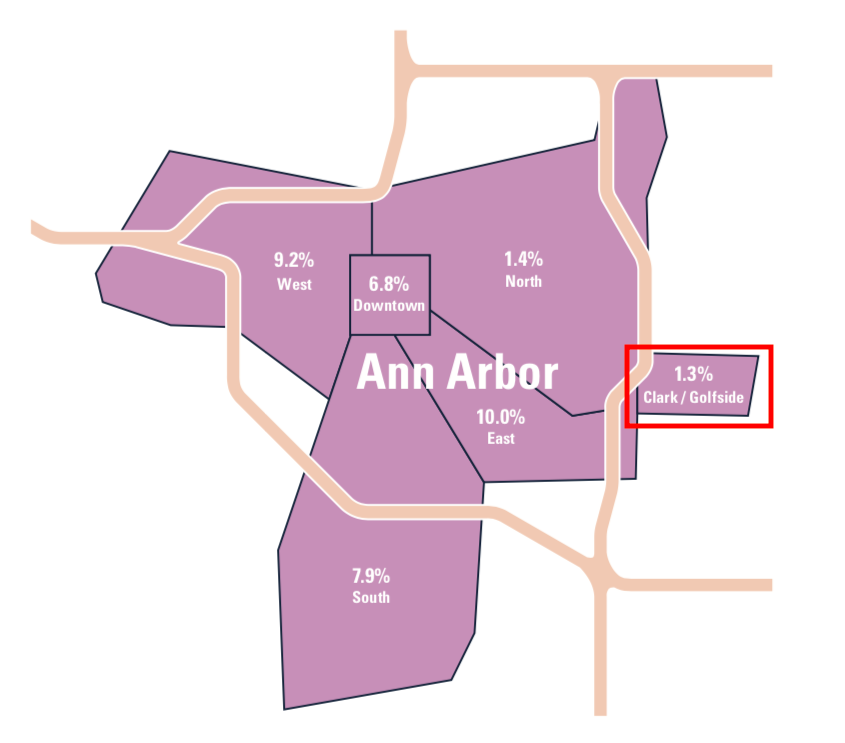

- The Clark-Golfside Medical Office Area vacancy rate experienced a considerable drop for the second consecutive year decreasing from 3.5% to 1.3%. (-2.2%). There appears to be a trend toward medical professionals consolidating into the larger medical campuses, rather than individually locating in the smaller outlying buildings.

The vacancy rate in Downtown Ann Arbor jumped up to 6.8%, and that’s ok.

- The majority of this change is due to two downtown buildings showing large vacancies of approximately 30,000 square feet each. One of those buildings is marketing the second and third floors as office suites for the first time in decades. In addition, there are a number of smaller office suites that remained vacant at the end of 2018. All in all, the demand for downtown office space was less intense than in recent years.

- This may also have to do with the south office area experiencing a higher level of demand, as larger companies looked to less impacted markets.

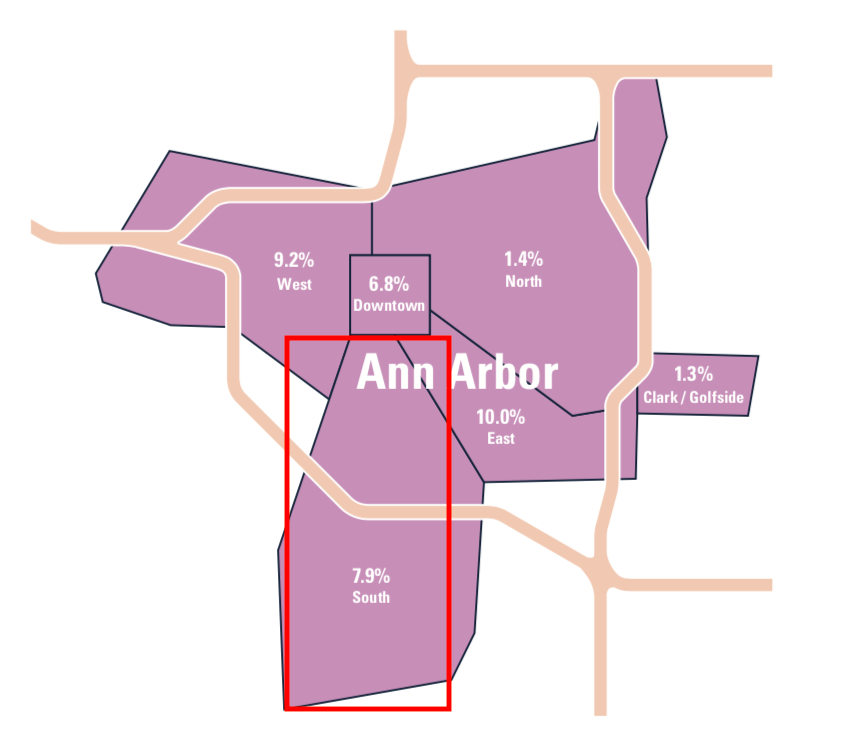

The South Office Area experienced nearly a 5% drop in vacancy rate. That’s a lot.

- The SOA is the largest office market in Ann Arbor, and the vacancy dropped from 14.2% to 9.7% in a single year. It also contains the largest blocks of contiguous space for potential users. This availability contributed to the leasing of substantial square footage to a single user. The impact represents a nearly 1% decrease in the total market vacancy rate.

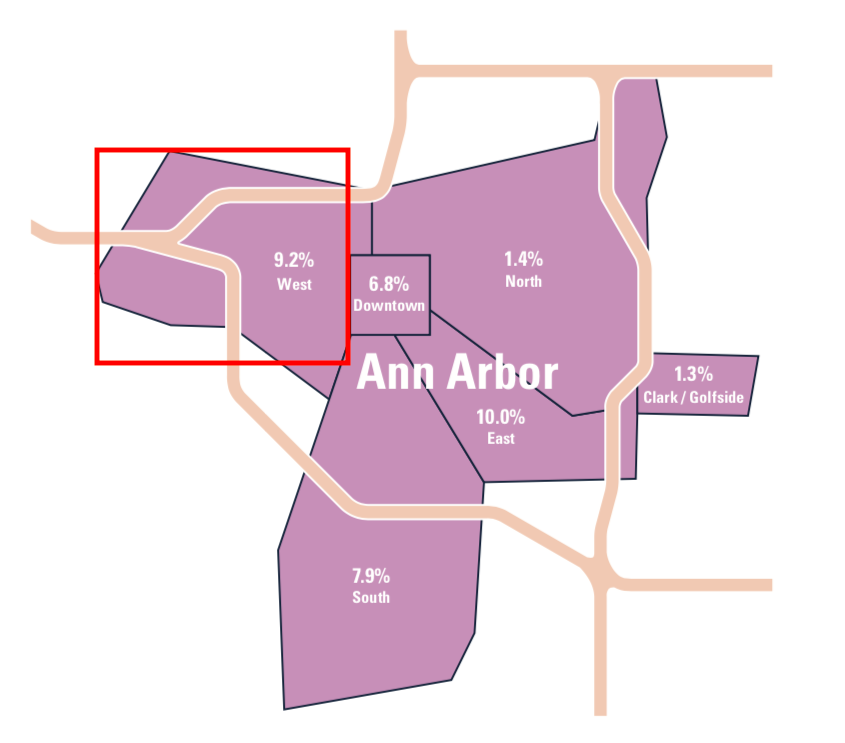

West Ann Arbor’s vacancy rate doesn’t tell the whole story.

- The vacancy rate in West Ann Arbor decreased from 17.2% to 12.7%. Most of the rate decrease is due to a 10,000 square foot occupancy gain in one office park west of Ann Arbor and a 9,000 square foot occupancy gain at another office park off West Stadium Blvd.

- It should be noted that over 50% of this vacancy is due to an empty 38,000 square foot building on Jackson Plaza.

- Statistically, this is a small area subject to wide swings in vacancy rate caused by changes, year to year, of the larger buildings.

All in all, the vacancy report tells the story of a vibrant real estate market and a thriving economy.